Turn ideas into results with proper financings

See tangible outcomes

Key Consultation

Speed Wins

Efficient Process

Industry Networks

Here's what The Loan Business is

About us

Unlike bank-owned entities or those embedded within commercial or residential real estate brokerages, we remain independent, ensuring unbiased matches with lenders, free from any affiliate incentives. Moreover, we exclusively advocate for you throughout the financing journey, representing, assisting, and negotiating on your behalf with the lender.

More Lucrative Options

Gain a partner, not just a vendor

Have you ever found yourself with a list of many buyers in your contact book that has the same buy box? If you are a seasoned agent with years in the trenches, then you would know It can get interesting (and tricky) when you have one good deal that fits the buy box of all these buyers. Who should you hit up first? (assuming your buddy buyer’s capital and time is currently invested and maxed out with other deals, and you just happen to always make more fruitful business relationships?). And more importantly, whoever you’re going to hit up first, chances are, they will say yes since it is a good deal. But let’s face it, how confident are you in this buyer and a smooth escrow in your first rodeo with them?

It’s a tough cookie to crack, in both residential and commercial sides of town (in our experience, much more so in commercial).

For that, we always recommend any agents to pass us the details of the potential buyers that they’re considering choosing to represent so we can do a general prequalification and send back our professional feedback on how strong and ready of a buyer this person would be for this particular deal/listing you’re looking at. For commercial buyer agents, we also recommend doing this. However, since the lending qualification is heavily based on the performance of the property in subject, which makes it usually a stand alone basis. However, the general idea would be the same. We would tell you how strong and how ready a buyer this person would be once we have a good conversation with them. Moreover, commercial strictly speaking, we will most likely send you feedback on what type of property and price tag you’d want to keep an eyes out for them and you can make a decision whether or not those would be aligned with their expectations. Meaning, are they realistic?

Here, at TLB, we also make listing agent’s lives easier by crunching numbers on their listing and telling them the most typical borrower profiles that would fit to qualify and buy the listed property so they can vet through the buyers’ inquiries much quicker and more efficiently. How? Mostly from the experience working through countless escrows, we have an extensive knowledge of what type of buyers/borrowers would best for certain subject property (timeline is an important factor, too). Moreover, for the more complicated and higher price tags than usual (typically in the commercial sector), we also have back end access to the account executives if we need quick quotes or feedback regarding the deal. All of this so we could get back to the listing agent with our report and professional feedback. For the agents that works with us, this has evidently save them hundreds of hours and much headache while significantly reduce rate of escrow fallout.

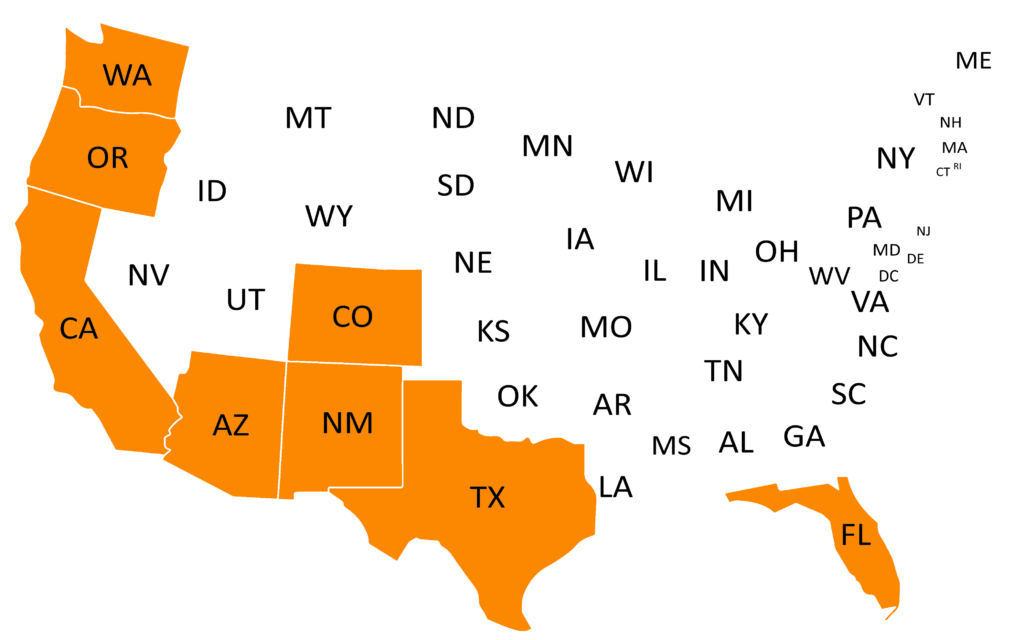

The states we can operate

Browse our loan programs

Purchase and Refinance for Office Buildings, Retail Properties, Industrial Properties, Multi-Family Properties, and Hotels.

Purchase and Refinance for All Types of Businesses, with Most Entities Setup, Experience, Years in Business, and Financial History.